As Tesla begins sales in India, it will come up against challenges from long-time Chinese rival BYD, as well as local player Tata Motors.

Tesla will finally start selling its cars in India, with the Maharashtra RTO clearing the way for Elon Musk’s electric vehicle giant to open its first showroom in Mumbai and begin road trials and sales. The Elon Musk-led company was inaugurated its first showroom at Bandra Kurla Complex (BKC) in Mumbai on July 15.

The trade certificate, granted under Rule 35 of the Central Motor Vehicle Rules, allows authorised dealers and manufacturers to move unregistered vehicles legally on public roads under specific conditions. It is valid for five years and permits activities like vehicle display, test drives, delivery runs, and workshop movement.

The company has selected a premium location for its first retail outlet. Tesla’s showroom is located on the ground floor of the Maker Maxity commercial complex, adjacent to a shopping mall at North Avenue in Mumbai’s BKC. Tesla is also likely to officially launch direct sales to Indian customers.According to reports, Tesla plans to launch its bestselling Model Y in India initially.

It will likely be sold in the country as a completely imported unit. Earlier, a report by Bloomberg suggested that the imported units were valued at Rs 27.69 lakh, with over Rs 21 lakh in import duties.

Tesla in India

- Launch: Tesla is officially entering India with showrooms ( experience centrer) opening in Mumbai on July 15, 2025, followed by another in New Delhi later this month.

- Import-Only Strategy: Initially, Tesla will import all vehicles (Model Y and eventually Model 3), without local manufacturing, meaning prices will be inflated by ₹46 lakh) before tax and insurance .

Challenges:

Premium pricing in India’s price-sensitive market (EVs currently <2 % of sales, with mass-market EVs priced under ₹20 lakh)

Absence of Supercharger infrastructure locally.

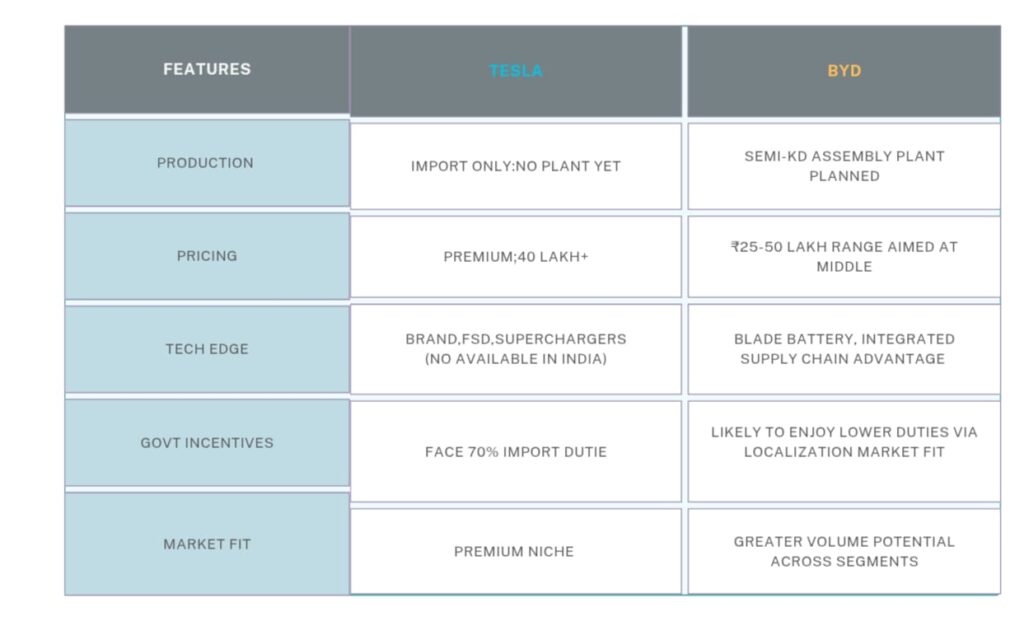

Here’s how the Tesla vs BYD “battle” in India begins up:

🔋 BYD in India

Current Presence: BYD has sold about 3,500 passenger cars in India so far (<0.1% of global volume) due to past regulatory hurdles .

Assembly & Local Production Plans:

- Assembling electric buses and Atto 3 SUVs in Tamil Nadu since late 2022 .

- Now planning a ₹85,000 crore (~$10 billion) manufacturing plant near Hyderabad (Telangana) with an initial capacity up to 600,000 EVs annually . However, approval issues remain due to FDI scrutiny .

🇮🇳 Indian Market Context

- Market Size & Structure: Passenger EVs account for <7.5% of sales; Tata leads with 62% market share. Model variety and charging infrastructure are still limited .

- Regulatory Environment: Govt is offering import duty cuts (to ₹4,150 crore, ramp-up targets, assembly plant within 3 years, local value addition of 25–50%) .

- Domestic Rivalry: Established local manufacturers (Tata, Mahindra) are aggressively scaling EV offerings that undercut both Tesla and BYD on price.

🏆 Who Has the Upper Hand?

- Short-Term Advantage: BYD, with its local assembly, competitive pricing, and diverse portfolio, is better positioned to capitalize immediately—especially if plant approvals go through.

- Long-Term Potential: Tesla can disrupt the premium segment, but must reduce prices substantially, build infrastructure, or begin local production to compete broadly

- Wildcards: Indian EV import policies, FDI scrutiny for Chinese firms, and international relations could shift the balance—Tesla avoids Chinese stigma but must play tariff and scale game; BYD may face geopolitical roadblocks.

“India is also a very price-sensitive market, and Tesla’s cars fall into the premium to luxury segment, making market penetration even tougher.”

The exemption is for cars over $35,000 plus companies only get to import 8000 cars a year…and they have to invest ₹500 million in the first 2 years to qualify.”

✅ Summary

BYD is strategically better placed to scale early thanks to assembly, lower costs, and product diversity.Tesla arrives with flair, brand prestige, and tech promise, but must tackle duties and infrastructure gaps.

Market outlook: Expect BYD to seize volume in 2026–27; Tesla to carve a niche in the premium market unless it pivots to local production and affordability.